Ultimate guide to smoothly conduct your legal audit

The audit has become an indispensable service to offer to your clients. Discover how to save time in writing your audit reports.

Why is it interesting to offer a legal audit service to your clients?

A legal audit is tasked to analyze and provide recommendations on situations related to the application of law.

Benefits of the legal audit for your firm:

- New sources of income;

- Improved credibility with your clients;

- Competitive: your offer differentiates from other services offered by competing firms.

The generally flat-rate nature of the audit encourages firms to greater efficiency and time optimization in implementing their audit services.

Steps to properly set up your audit service:

- Promote your legal audit services

- Obtain your client’s agreement

- Send them a form

- Receive the completed form

- Utilize the data

1. Talk about your legal audit services

Promote your audit services via your website, your social networks, or during a first consultation with your client.

Examples:

- The law firm Solis Law has created a platform called Avocadoc which allows for online registration for a tax audit;

- The firm Centrius offers audits through its social networks, including for a review of general conditions.

2. Obtain your client’s agreement on the audit’s object and price

It is wise to detail the type of audit you offer and its stages. It is therefore essential to set and explain a framework to your client.

Examples of audits:

- GDPR compliance, IA Act, MiCa, NIS 2, CRA;

- Environmental impact of a real estate project;

- Due diligence;

- Intellectual property diagnosis;

- Dispute between associates;

- AML;

- Tax optimization;

- Estate planning.

Next, propose a flat rate to your client. This has several advantages for your firm, as opposed to the hourly rate.

Advantages:

- The hourly rate is often poorly perceived by your clients, whereas the flat rate reassures them: they know exactly how much they will pay.

Example: Your client loses a certain degree of freedom in their exchange with their counsel, when they do not know how their next invoice will be formulated. - The hourly rate also induces an additional mental burden on you: management of timesheets, justifications of fees to your clients, to your bar association during disputes, etc.

3. Send your client a secure link to the audit form via email

To provide your guidance and write your report, you need a range of information regarding your client and their activity.

The form is an excellent way to collect the information:

- Time-saver: Given the flat-rate nature of the audit, you should not waste your time with back-and-forth emails or phone calls with your client to get the necessary information. Your audit must be profitable.

- Data centralization: The form collects at once and in a single communication channel all the necessary information. Without a form, you risk scattering the information across different channels (LinkedIn conversation, emails, SMS, etc.), which makes data centralization difficult and time-consuming.

- Data structuring: The form automatically structures the data collected to facilitate their later processing.

Examples:

- Compile and export the uploaded files in PDF format.

- Automatically rename the uploaded files.

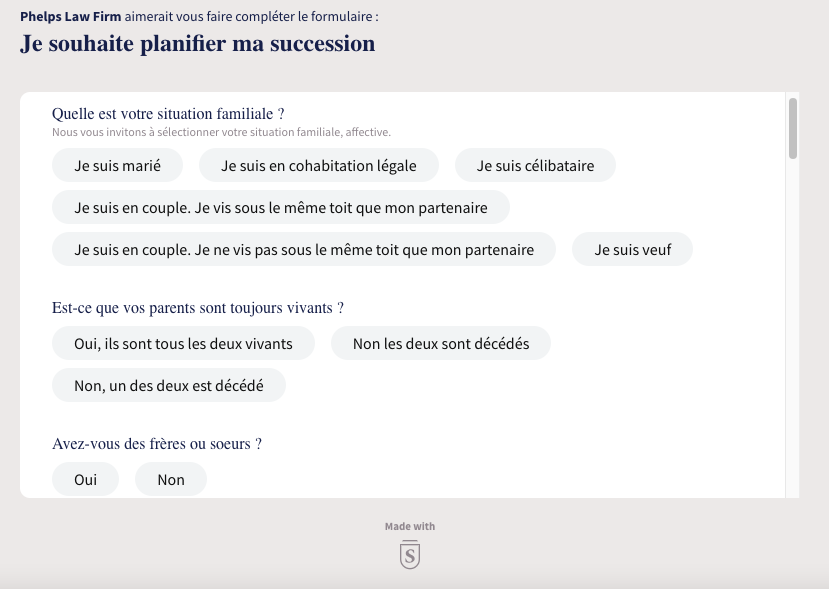

4. Your client fills out and submits the form to you

Let us take a concrete example of a lawyer we recently assisted.

He specializes in inheritance law.

He received information and documents from his clients piecemeal, which they sent to him by email.

Problems:

- Client requests were generally incomplete,

- The lawyer regularly had to send dozens of follow-ups by email to complete the file,

- He therefore spent a lot of time and energy, just to compile the file.

By asking his clients to fill out a form upfront, he drastically reduced the volume of email exchanges with his clients to compile his audit files.

Today:

- He saves a lot of time: From half an hour to one hour saved per audit.

- His mental workload has decreased: He can focus on the audit itself.

How to optimize your form?

To increase the filling rate of your form and reduce the abandonment rate :

- Ask only mandatory questions: your clients tend to not complete optional fields, don’t waste time asking them;

- Ask a maximum of closed questions (single or multiple choice questions) or concise and precise open questions that require short answers;

- Simplify the vocabulary to ensure good understanding by your clients;

- Make your form dynamic.

5. Exploit the data collected via the form

When you receive the form completed by your client, several opportunities to exploit the collected data are possible:

Link your form to a Generative Artificial Intelligence

The AI will pre-draft your audit report, based on the information collected in the form and your previously drafted reports.

Objectives: Automation and productivity.

Integrate your form with your law firm management or billing software

The structure of the data in the form allows for automatic transfer of information to your preferred application.

Objectives: Avoid manual copying and encoding errors.

Discover Symplicy

Law firms of all sizes seek us out for:

- Creating intelligent forms covering multiple audit situations.

- Helping them process and take advantage of the data collected through the form, especially for writing their audit report.

Adopt our smart form today for your audits!

You might also like...

Symplicy and VoxNow announce a collaboration aimed at automating your missed phone calls

Symplicy and Septeo Lawyer Solutions announce a collaboration to automate attorneys’ matter openings.